Spark® Cash Back Rewards from Spark® Business Credit Cards rated for 5 star by Capital One Business for our United States readers, especially for you at New Orleans, LA, USA. Capital One Business comes to explores reviews about capital one business 360 credit cards, auto loans, banking accounts, and services including savings and checking

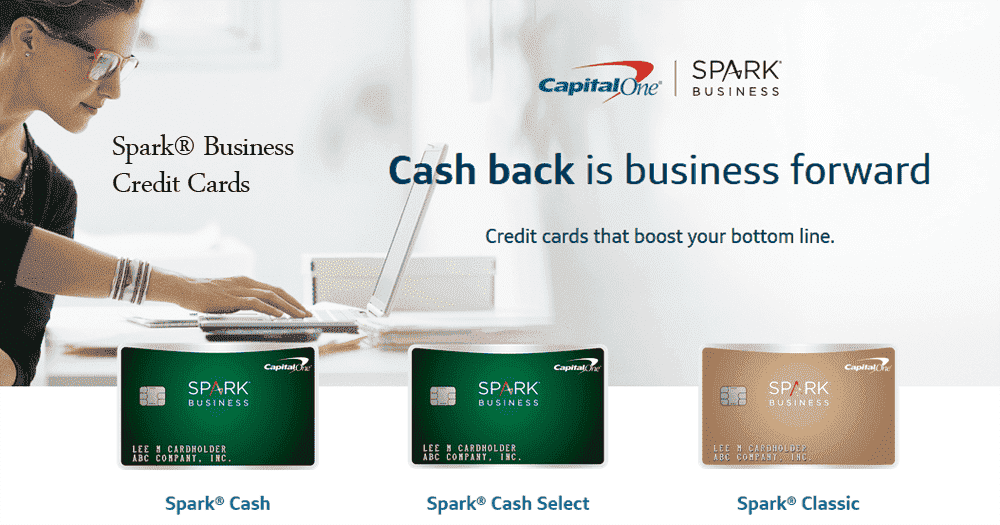

Spark® Business Credit Cards.

Spark® Cash Back Rewards from Spark® Business Credit Cards. Cash back is an advanced business. Credit cards that increase your profits. Get unlimited cash back rewards on every purchase for your business with a Spark Capital One cash gift card.1. Spark® Cash.

- Credit Level: Extraordinary Credit.

- Rewards Info: Unlimited 2% cashback for every purchase, every day.

- New Cardmembers: Get a one-time $500 cash bonus after you spend $4,500 for purchases in the first 3 months after opening an account.

- Purchase Rate: 19.24% APR variable.

- Transfer Info: 19.24% APR variable; No Transfer Fee.

- Annual fee: $0 intro in the first year, $95 after that.

2. Select Cash Spark®.

- Credit Level: Extraordinary Credit.

- Rewards Info: unlimited 1.5% cash refund for every purchase, every day.

- New Cardmembers: Get a one-time $200 cash bonus after you spend $3,000 on purchases within the first 3 months of opening an account.

- Purchase Rate: 0% APR intro for 9 months; 15.24% - 23.24% APR variables after that.

- Transfer Info: 15.24% - 23.24% APR variable; No Transfer Fee.

- Annual Fee: $0.

3. Spark® Classic.

- Credit Level: Average Credit.

- Rewards Info: Get the credit you want for your business, and a 1% unlimited cash refund on every purchase, every day.

- New Cardmember Offer: None.

- Purchase Rate: 25.24% APR variable.

- Transfer Info: 25.24% APR variable; No Transfer Fee.

- Annual Fee: $0.

Credit Level Guidelines, Which of the 3 best describes you?

- Extraordinary Credit. You have never declared bankruptcy or failed a loan; You have not been more than 60 days late with a credit card, medical bill, or loan in the past year; You have had a loan or credit card for 3 years or more with a credit limit above $5,000.

- Average Credit. You have failed to pay a loan in the last 5 years OR you have a limited credit history. You already have your own credit card or other credit for less than 3 years (including students, people who are new to U.S., or official users on other people's credit cards).

- Rebuilding Credit. You failed to pay the loan more than once. OR You have been denied a credit card in the last 3 months.

Every purchase can increase your profit

With a Spark cash gift credit card, every expenditure can be an opportunity to return thousands of dollars to your business. Get unlimited cash back for equipment, inventory, advertisements, and everything in between.Spark® Cash Back Rewards from Spark® Business Credit Cards.

For more reference about this post, find it on Bing, Yahoo.

Share this post to your friends on social media at:

0 Response to "Spark® Cash Back Rewards from Spark® Business Credit Cards"

Post a Comment